04 May 2021

Time to check your VAT Scale Charges!

If your business is VAT registered and reclaiming VAT on road fuel which may be used for private journeys, then a scale charge must be added onto the outputs on your VAT return.

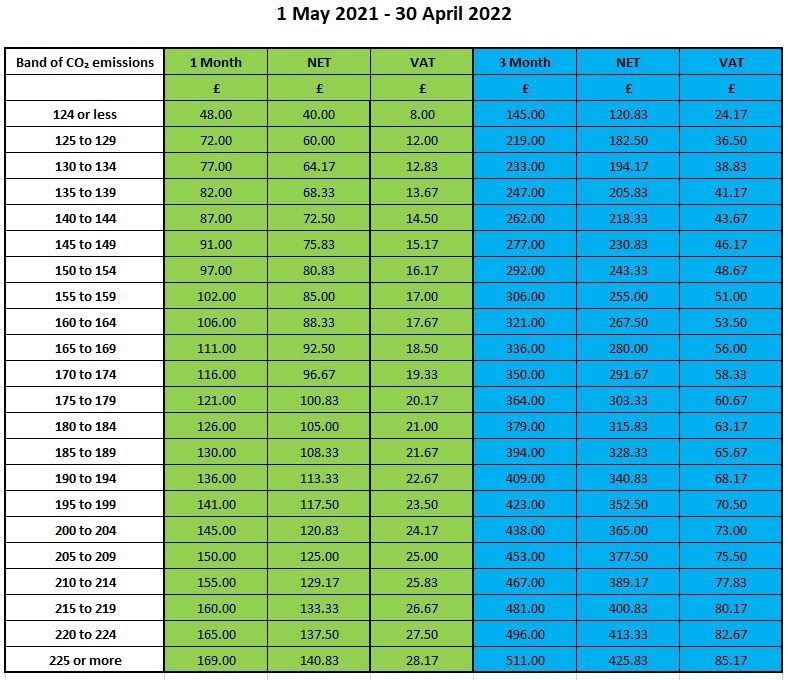

From 1 May 2021 HMRC have changed the scale charge values, which are determined according to a car’s CO2 emissions. The new scale charges apply to the first full VAT period beginning on or after the 1st May 2021. You need to apply a scale charge for each car which has private fuel paid for by the business, so you may need to apply more than one scale charge to your VAT return.

The alternative to having to apply a scale charge is to not claim the VAT on road fuel for any vehicle, or to pay a rate per mile rather than putting the fuel bills through the business. Please contact Jo Coleby on 01228 530913 if you would like to discuss the best option for your business.