Many of us will have breathed a sigh of relief when the Government announced that the introduction of Making Tax Digital for Income Tax Self Assessment (MTD ITSA) was being delayed until April 2026 (it had been scheduled for introduction from April 2024). However, one side effect of MTD ITSA that was not delayed was Basis Period Reform.

Basis periods dictate the way in which the profits of an unincorporated trading business (sole trades and partnerships) are allocated to tax years. Historically the basis period has been determined by the accounting period which ends in the tax year in question. So by way of an example, a sole trader who prepares her accounts for the year to 30 June 2022 would report those profits in her 2022/2023 tax return and they would be taxed accordingly.

However, for the 2024/2025 tax year onwards, the basis period rules are being reformed such that all unincorporated businesses will be taxed on their trading profits in line with the tax year. So in the case of our sole trader, if she continues to prepare her accounts to June each year, the 2024/2025 tax year would include 3/12 of the profits for the period to 30 June 2024, and then 9/12 of the profits for the period to 30 June 2025.

Arguably the main difficulty with these changes lies in the 'transition year' of 2023/2024. This will require a business to not only assess profits to its normal accounting date, but to also identify additional "transitional profits". The transitional profits will be calculated by taking the profit covering the period from the end of the 'normal' accounting period through to 5 April 2024, and then deducting any overlap profits available (which are essentially profits that were taxed twice at the outset of the business).

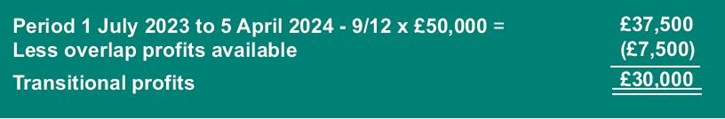

Sarah's sole trade business has a 30 June year end and now consistently makes a profit of £50,000. The business was not as profitable at the outset, and she has £7,500 of overlap profits brought forward.

Sarah's transitional profits are calculated as follows:

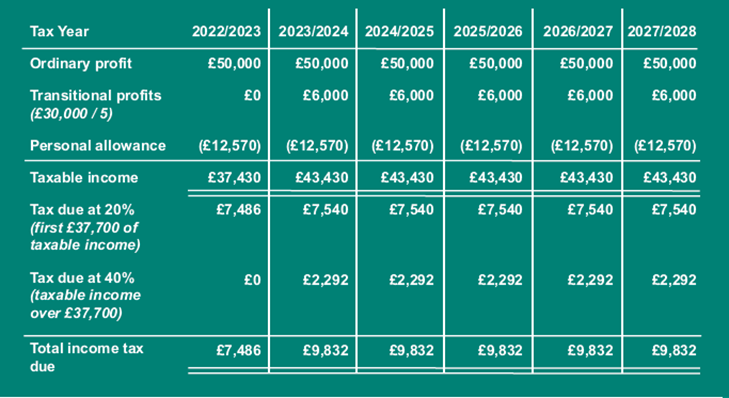

The default position is that the transitional profits will be spread over 5 tax years in order to mitigate the cashflow impact of the additional tax charge which could arise.

Assuming Sarah's 'ordinary' profits remain consistent at £50,000, her assessable profits and income tax liability would be as follows for the 6 tax years beginning with 2022/2023.

What we can see here is that Sarah, who previously had no exposure to higher rate (40%) tax, will suffer higher rate tax on almost all of the transitional profits.

Thankfully HMRC took on board concerns that the transitional profits could result in taxpayers suffering a High Income Child Benefit Charge (which applies where the household's higher earner's income exceeds £50,000), and made some technical changes which remove this risk. However the changes they made do not prevent the transitional profits from causing the tax-free personal allowance to be tapered where income exceeds £100,000, and so higher earning businesses may suffer further increased tax charges because of this.

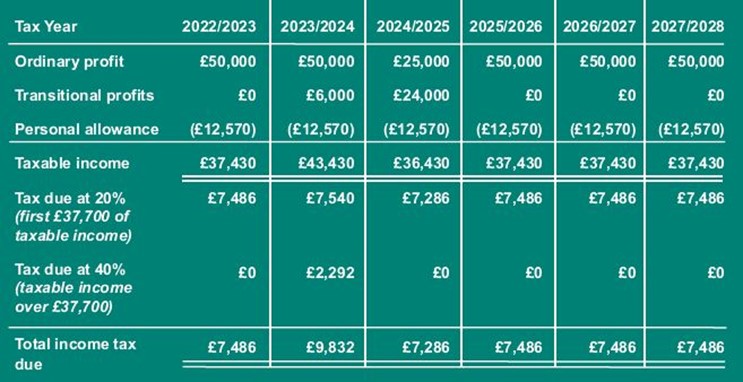

It is however possible to elect to accelerate the additional profits, and the taxpayer can pick any figure to bring forward into an earlier tax year. This may be helpful if for example the business has reduced taxable profits in one of the 5 years during the spreading period.

Sarah has decided she will simply draw up her accounts to 5 April with effect from the year ended 5 April 2024. In the year to 5 April 2025 she spends £25,000 on equipment which qualifies for the Annual Investment Allowance (100% tax relief) which reduces her 2024/2025 taxable profit to £25,000. She decides to elect to accelerate the assessment of the transitional profits so that all of the remaining transitional profits are assessed in the 2024/2025 tax year.

By making the election to accelerate the transitional profits, Sarah has significantly reduced the level of profits that are subject to higher rate tax.

Naturally it will not always be practical or desirable for large sums to be spent on equipment. There are however other alternatives that could be considered to mitigate the impact of the transitional profits, such as making personal pension contributions (which extend the basic rate tax band and reduce the amount of income that is exposed to higher rate tax), or using farmers' averaging.

From a practical viewpoint, we would envisage most businesses changing their accounting date to 31 March or 5 April in order to avoid the complication of having to apportion two different accounting periods to a tax year. However there may be some businesses which have year ends other than 31 March or 5 April for good commercial reasons, perhaps because a certain time of year is more appropriate to carry out a stocktake. These businesses may decide to retain their current accounting year end, and simply accept the additional administrative burden that these changes have caused.

Finally, although MTD ITSA has now been delayed, the Basis Period Reform does still highlight the importance of maintaining 'real time' accounting/management data. For example a profitable partnership which may have historically drawn up accounts to 30 April each year so that the partners had 11 months to draw up the accounts and tax computations for the tax year in question and consider making a personal pension contribution (before 5 April the following year) will no longer have that luxury. However, if the business keeps accurate accounting/ management data then they should be able to plan their tax affairs on a real time basis without needing to rely on the benefit of hindsight.

By Jonathan Ridley (Tax Partner)

Click here to read other Spring Farming Newsletter articles.