When Boris Johnson led the Conservative victory in the 2019 general election he won with the mantra of “get Brexit done”. Little did he realise at the time that Brexit would be the least of his problems! Almost two years on from his victory, there are signs of hope we will successfully emerge from the Coronavirus pandemic but there is lasting damage to both public and Government finances. The Office for Budget Responsibility has forecast that in the two years from April 2020 to April 2022 (when there is hoped to be lasting success in beating Covid-19) Government borrowing will have increased to an eye-watering £589 billion. Indeed, national debt is already in excess of £2.1 trillion.

But what does this mean for farming families? Well, the Government now has a challenge on their hands with how to manage the public finances. No doubt there will be endless debate over how this should be done; austerity, tax changes, spending programmes on infrastructure etc etc. When looking at tax changes the question is where might additional tax revenue be raised? Particularly in light of the Tories’ continued pledge to honour their tax triple lock on Income Tax, National Insurance and VAT – the three key revenue raisers for the Government.

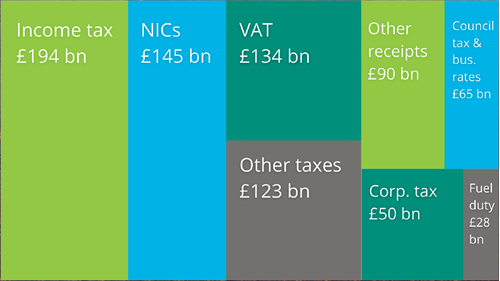

The chart below shows where the Government currently collects its tax revenues:

Source: https://commonslibrary.parliament.uk/research-briefings/cbp-8513/

Conspicuous by it’s absence is inheritance tax. Whilst probably the most despised tax, it raises a mere £5.6bn a year for the Revenue. In the past there has been enormous political pressure to leave inheritance tax alone. In an era of Coronavirus debt however, it may just be the low- hanging fruit the Revenue are looking for

Farming has long enjoyed a very sympathetic tax regime for inheritance tax. In fact, it has enjoyed a very sympathetic tax regime for succession as a whole, with the ability to pass down agricultural assets to the next generation either in lifetime (with a holdover election) or on death (with Agricultural Property Relief (APR) and Business Property Relief (BPR)). So long as the assets meet various criteria, that they’re used for farming or in the business and for a minimum number of years, then estates and businesses could be handed over with no adverse tax implications. A particular quirk with land and assets that are inherited is that the recipient is deemed to receive the assets at current market value. This means that not only can you pass assets down worth millions to your children with no tax, they can then sell them on if they wish with no Capital Gains Tax either. Bizarrely this “win win” of succession tax reliefs has often been to the detriment of succession itself, with people clinging on to assets for the tax benefits when it may have been more appropriate pass them on to the generation farming the land.

These tax reliefs have attracted investment from the city, where investment has taken place purely to shelter from inheritance tax. Land bought but not farmed by the owner (i.e. let on an FBT) still attracts 100% APR after 7 years. So the tax changes could affect agriculture and succession in a big way – perhaps no surprise land agents view tax as the biggest driver of land value changes, according to the survey discussed in the future of land values article.

What might change?

Well, it’s all best guesswork at this stage. We don’t know for sure what changes will be implemented, or when. But we can take some direction from the government review undertaken in 2020 and chaired by the MP for Carlisle, John Stevenson. A review of inheritance tax by the all-party parliamentary group for inheritance and intergenerational fairness concluded that fundamental changes are required and suggested:

- Abolishing the current inheritance tax systems

- Replacing with a tax on all gifts, both in lifetime or death (effectively a wealth transfer tax)

- A relatively low tax rate of 10-20% on these transfers

- Very few reliefs (so Agricultural Property Relief and Business Property Relief, that shelter

the majority of farming estates, would be abolished) - Capital Gains Tax uplift on death to be abolished (so the ability to “wash away” a Capital

Gains Tax issue on death would go) - More powers to H M Revenue and Customs to ensure all transfers and gifts above the £3,000

limit are reported and recorded

This could have far-reaching consequences for agriculture and it remains to be seen just how far any changes would push the tax boundaries, particularly the removal of APR/BPR. For the classic scenario of the asset rich/cash poor farming business, however any changes to the current regime will need to be closely monitored.

What is the take away message?

Well for many, particularly where succession has recently happened and the assets are predominantly held by those with many years ahead of them, any inheritance tax changes may be of little concern. Over the years governments will come and go and there will be future changes and overhauls to the tax system.

The key is for those that have been meaning for years to pass on their farming assets but have never got round to it (let’s be honest, there has been no urgency given the current tax regime). But in this situation is there now any reason to delay? There are potentially wide sweeping changes to come, driven by a huge Coronavirus bill, which could be very costly for landowners. Yet if you gift land and business assets right now with holdover relief you can get valuable assets to the next generations with no tax. And as far as the tax planning goes, you can’t do better than knowing there will be no tax on the transfer of the family farm.

Written by Andrew Sims, this is an opinion piece only. Specific tax advice must be taken for your business. To discuss any of the above please contact your usual Dodd & Co advisor.

Click here to read other Spring Farming Newsletter articles.