NHS Pension Scheme member contribution changes from 1 October 2022

Many of you will know about the changes to the member contribution tiers that have taken effect from 1 October 2022. Tiers are now based on actual pensionable pay as opposed to whole time equivalent (WTE), and reassessed if there are permanent changes to pay. This appears to be a more workable way of calculating pensionable pay – unless you have part time employees who work additional hours, in which case, you need to look at the calculations more closely.

The Department of Health & Social Care have confirmed that employers need to include any overtime (paid at standard rate and within WTE) in an annualised earnings calculation to define the pension tier. If this results in a change to the current pension tier, the new contribution rate must be applied from the start of the next pay period.

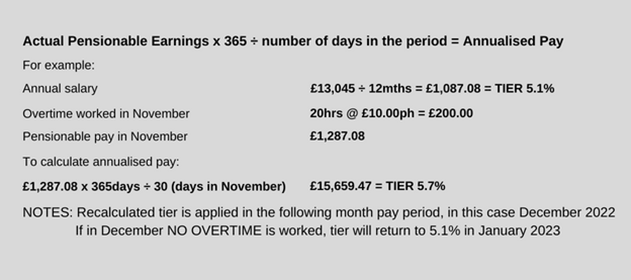

The guidance provides a calculation for reassessment purposes as follows: -

In summary, for part time employees, that work additional hours – their pensionable annualised pay must be recalculated each month to determine the tier for the next pay period. Employers must be ready for questions from employees who may have less in their pay packets than they expect, due to the tier system working a month behind.

If you wish to read the updated guidance which clarifies position for part time members who work additional hours, you can read it here.

The NHS Pension Stakeholder Engagement team have arranged some events in early December providing further information on the changes, click here for details.

For help and advice contact Helen Tyson.